Your Expert for Financial Processes

The demands on the financial system in your company are growing and you don’t want to just react, but position your department securely for the future? Then we are the ideal partner for you. Our consultants not only specialize in SAP Finance, but in accounting too. They speak your language and know how to set up your accounting digitally and intelligently.

Digitalization accounting with SAP S/4HANA

The role of finance in the company is changing rapidly – shifting from an observational to an increasingly steering function. At the same time, financial processes are becoming more complex. Efficiency, speed, and transparency are required. If you want to remain fit for the future, you need intelligent technologies to automate and optimize your accounting tasks. SAP S/4HANA Finance is ideal for this.

The introduction of SAP S/4HANA fundamentally changes the financial and accounting system as you can create reports in real time even from huge amounts of data. Thanks to S/4HANA Embedded Analytics, transactional data is available instantly and without delay – in real time and on the fly. The system is also open for collaboration across departments and corporate boundaries. Companies can consolidate information from different sources, such as controlling, accounting or liquidity management, and produce reports flexibly, in line with their own preferences. Fiori apps enable a new, contemporary way of presenting the data, from a wide variety of end devices as well. Dashboards, for example, provide a quick overview.

Uniform view with Universal Journal

Our solutions for the most common challenges

Accounting

Whether it’s monthly, quarterly, or annual financial statements – with SAP Finance you can automate and optimize your accounting and reporting quickly and safely. Reduce your manual workload and give your finance team more time to manage strategic tasks.

Statutory, country-specific reports such as sales tax declarations can be created and submitted electronically to the tax authorities on time using SAP Document Reporting and Compliance (SAP DRC). The calculations in these reports comply with the legal requirements. SAP DRC also helps establish and track approval processes with integrated workflows.

Intercompany transactions can be easily and automatically reconciled using the Intercompany Matching and Reconciliation (ICMR) solution integrated in SAP S/4HANA. The solution makes it possible to reconcile records from subsidiaries in real time using flexible intercompany matching and reconciliation rules. This allows month-end work to be carried out while it’s still business as usual, thus reducing the time required to close the month. SAP Fiori and a clear graphical representation of the reconciliation results simplify the communication and evaluation of data.

Since the SAP S/4HANA 1809 release, there is the GR/IR (Goods Receipts/Invoice Receipts) reconciliation monitor for the popular, time-consuming task of matching incoming goods and incoming invoices: The system automatically matches the data against a predefined set of rules. If this is not sufficient, the built-in learning capability draws on historical data sets.

Data silos tend to be inefficient and time consuming. Consolidating them at group level carries risks though in light of the many different companies, ERP systems, currencies or accounting rules. With the consolidation solution for Group Reporting integrated into SAP S/4HANA, companies can consolidate the financial statements of several subsidiaries or branches, providing an overview of the entire company’s financial situation.

Controlling

SAP S/4HANA Finance results in key changes for controlling: One of the biggest innovations is the standardization of general ledger accounts and cost types. Under the new approach, cost types are no longer accounted for separately, but are now defined as accounts with appropriate classification. Duplicate data storage is history now. Lengthy reconciliations between controlling and financial accounting can be eliminated as a result.

Profitability Analysis or results and market segment accounting, is an effective reporting component that can analyze earnings contributions across a market segment or strategic business unit. The market segments can be freely defined, in particular by products, customers and orders. Accounting profitability analysis has been integrated into Universal Journal with SAP S/4HANA, thus significantly enhancing the functions compared to SAP ECC. For example, fixed and variable costs can now be reported separately.

Integrated Financial Planning is the basis for operational controlling and reporting and is key to the company’s success. However, this is becoming increasingly complex in the face of global markets with greater product diversity and shorter product cycles. SAP’s strategic product for integrated financial planning is SAP Analytics Cloud (SAC) for SAP S/4HANA users. The intelligent cloud platform enables financial and operational plans to be drawn up and linked to each other across different businesses. SAC can systematically standardize companies’ fragmented planning processes using a variety of integration mechanisms.

SAC enables comprehensive integrated financial planning and predictions of future developments, from cost and revenue recognition to cash flow planning using predictive and simulation options. The budget can be presented in all balance sheet and profit and loss items using various predefined input masks, which can be individually adjusted. With SAC, you can create reports tailored to your requirements or standard reports relevant for management – for full transparency.

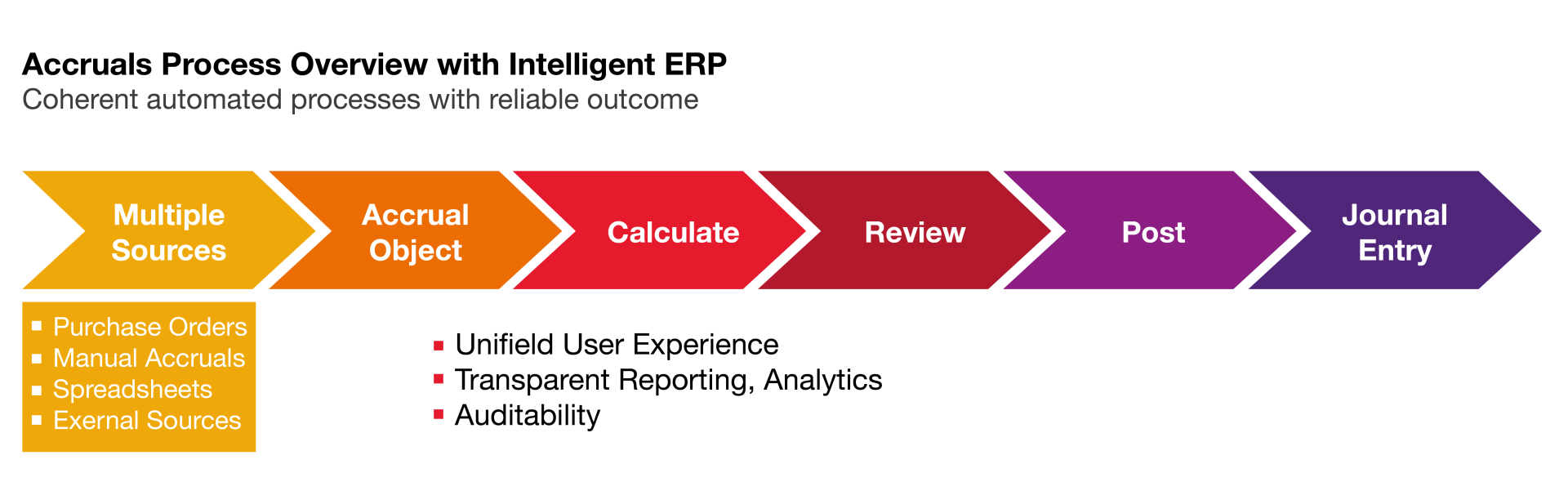

Accruals Management

Entering accruals manually is time-consuming and complex. Accruals Management in SAP S/4HANA helps optimize accrual postings, in particular through automation and troubleshooting. Accruals can now be determined and posted at the push of a button.

Benefits of SAP Finance

Real-time financial statements

Analysis tailored directly to user role

Accounting and controlling are optimally linked – both draw on consistent data

A single source of truth: Universal Journal is the central database for all applications

Excellent user acceptance due to application-friendly SAP Fiori apps

We are glad to help.

Do you need support with finance? You are welcome to contact us!