Ready for e-Invoicing?

In Germany, companies in the B2B business have to be able to receive, process and archive invoices in an electronic format from January 1, 2025. e-invoicing is one of the measures of the “Wachstumschancengesetz” (Growth Opportunities Act) passed in March 2024. Find out what you need to know about the new regulation and how to implement it here.

e-Invoicing takes effect from January 2025

Electronic invoices are becoming increasingly important in Germany and throughout the EU. With the Growth Opportunities Act, which is intended to relieve companies of tax burdens and reduce bureaucracy, companies will have to use e-invoices for VAT purposes in the B2B business from January 1, 2025. The obligation applies regardless of whether the company is a main or secondary business. In addition, the entrepreneur and service recipient must be based in Germany.

An e-invoice has a structured, machine-readable data format. It can be processed automatically and electronically in accordance with Directive 2014/55/EU – without the need for manual input. This enables a seamless digital process from invoice creation to payment of the invoice amounts.

Different invoice formats

E-invoices do not refer to PDFs; they are not considered electronic invoices for VAT purposes. Rather, they are XML formats, a text-based data format that presents information in a structured, machine-readable form. The EU Directive 2014/55/EU specifies the syntax according to UN/CEFACT XML CIID16B and ISO/IEC 19845 as file formats. In Germany, the two formats XRechnung and ZUGFeRD (Zentraler User Guide Forum elektronische Rechnung Deutschland) meet the requirements for this syntax.

The ZUGFeRD format uses a PDF/A-3 file in which the actual invoice file is embedded in XML format. It can be read by both humans and machines and is used to transmit invoices to other companies. The format allows data such as the invoice amount or invoice number to be read in a standardized way. The aim is to be able to process the invoice data without a media break. The OCR recognition (Optical Character Recognition) used to date is to be replaced in the long term.

XRechnung was specially developed by the German government to facilitate the exchange of information between companies and public administrations. It is also based on XML, but does not contain a visual PDF document. It is only machine-readable and is particularly suitable for e-invoices to public clients (B2G).

Which format you need depends on the individual business requirements and processes in your company.

Transitional periods

The deadline of January 1, 2025 applies to incoming invoices. Every company subject to VAT in Germany must be able to receive e-invoices from this date. However, there are generous transitional periods for sending e-invoices.

Transfer of the eInvoice: PEPPOL

Anyone dealing with e-invoicing will often come across the term PEPPOL. Back in 2008, the EU Commission created the electronic, Europe-wide PEPPOL (Pan-European Public Procurement On-Line) network for public tenders. It is used to exchange digital documents, in particular electronic invoices, between companies and the public administration (B2G). In some European countries, PEPPOL is the preferred transmission method for e-invoices and e-documents and can also be used for B2B.

Combination with inbound invoice automation

The introduction of e-invoicing is a good opportunity to combine inbound communication with a system for automated invoice receipt. This can save a lot of time and money. Inbound Invoice Automation products are currently in high demand. They can be connected via SAP BTP, for example. This significantly reduces the amount of work involved in invoice receipt and improves the quality of data capture. Employees in the finance department can use the time gained for more demanding tasks, such as making more informed decisions or ensuring that payment targets are met.

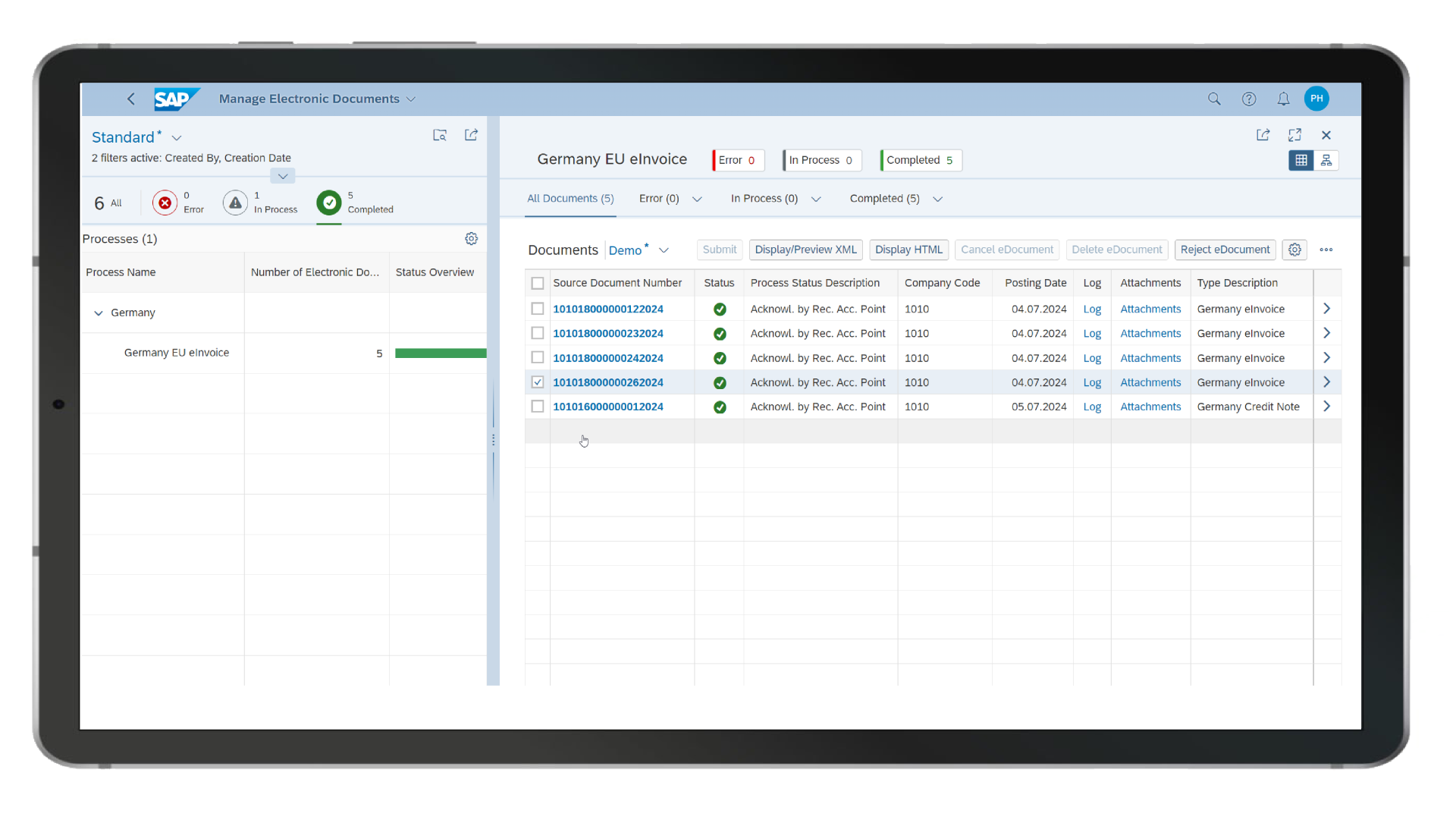

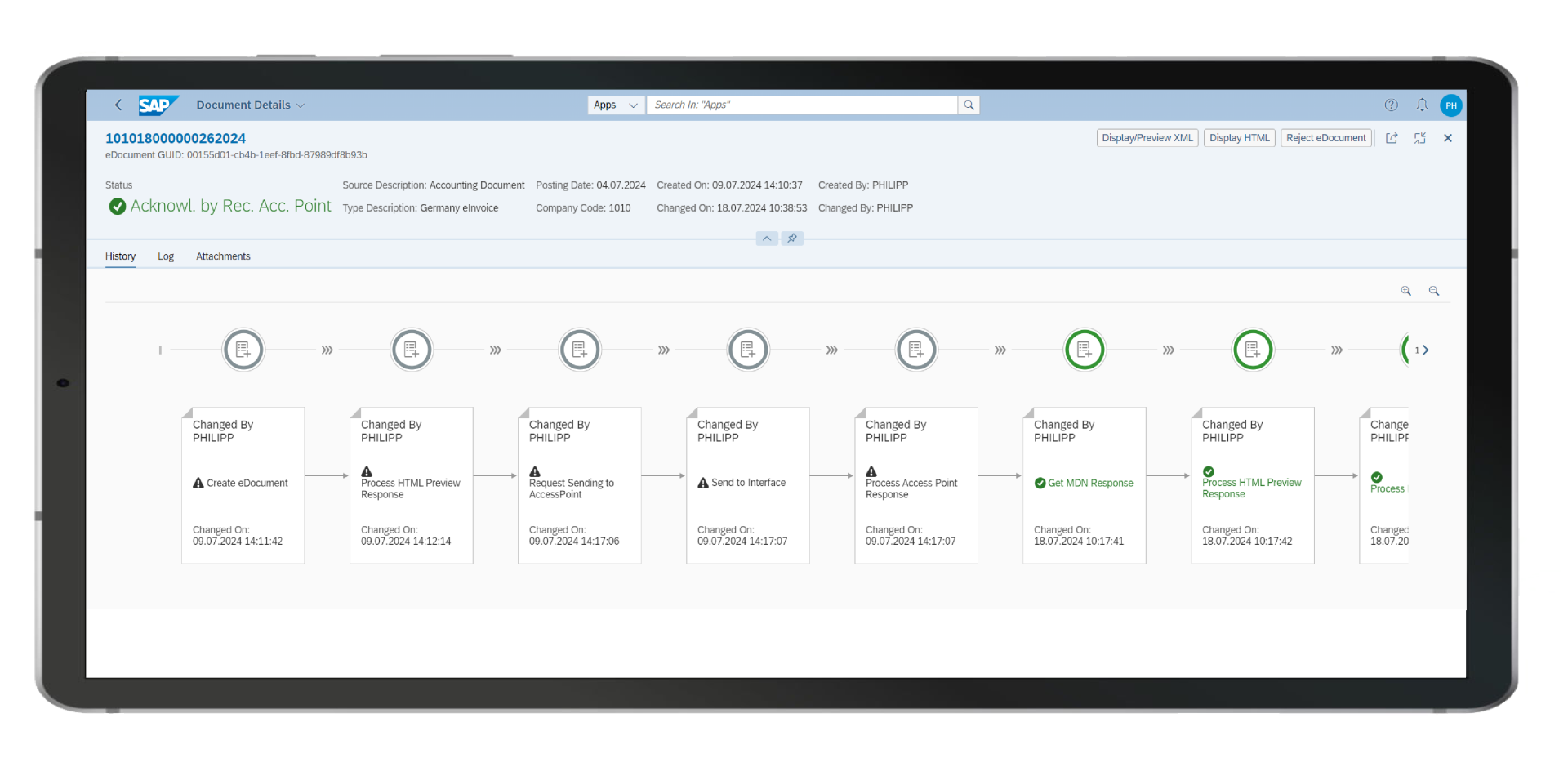

Demo system

We have developed a demo system with a range of different cases. This will give you an impression of how the processing of e-invoices can look.

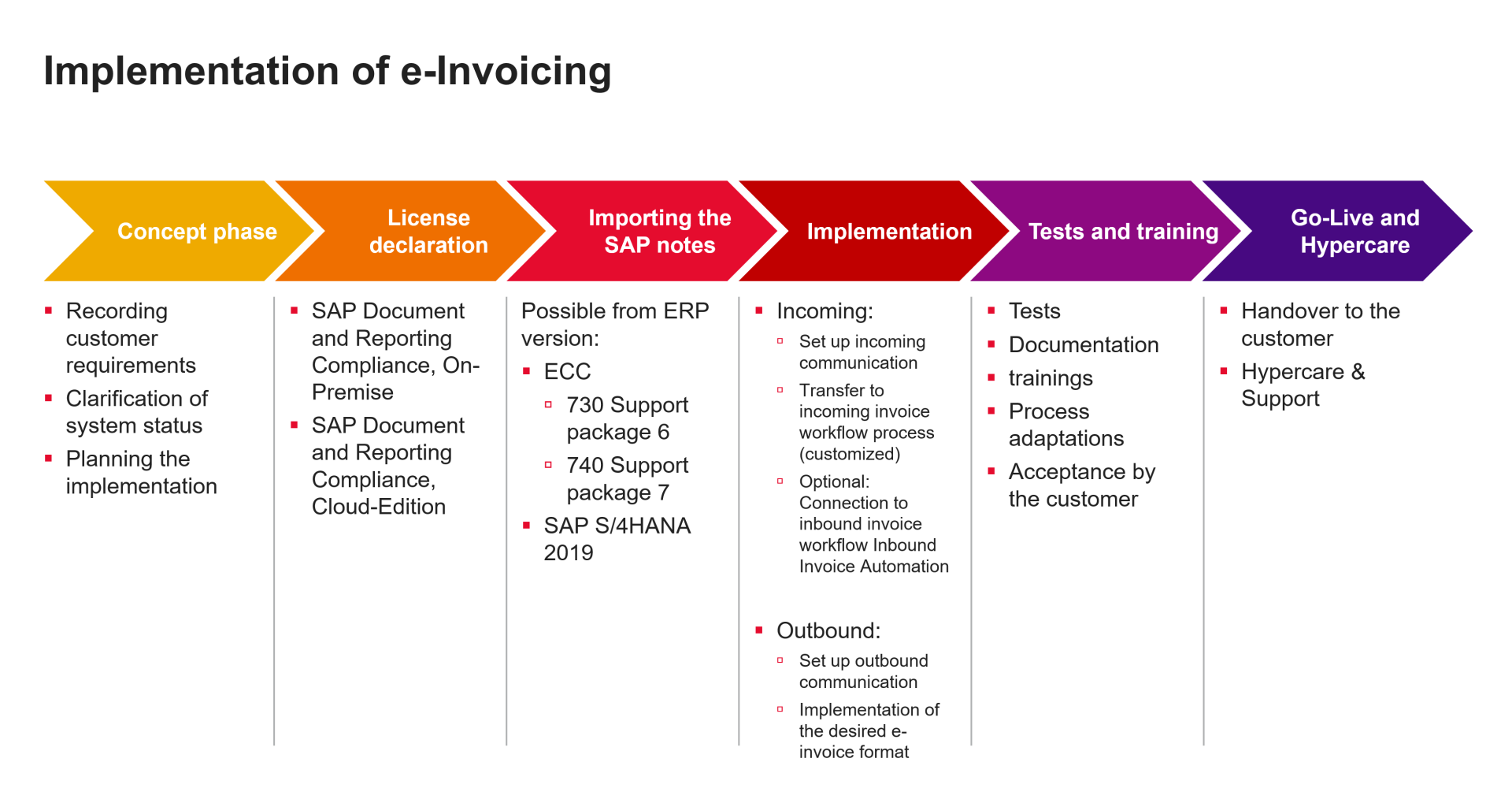

Changeover takes time

Even if the introduction of e-invoicing is gradual and generous transition periods are planned, every company must prepare for the receipt of e-invoices from January 2025. Those who have not yet started should hurry. The implementation of the relevant solution, the changeover and the tests take time.

With an experienced partner like consolut at your side, you can master the changeover process with little effort and prepare for the further digitalization of your finance department. Get in touch with us!

Author of the article